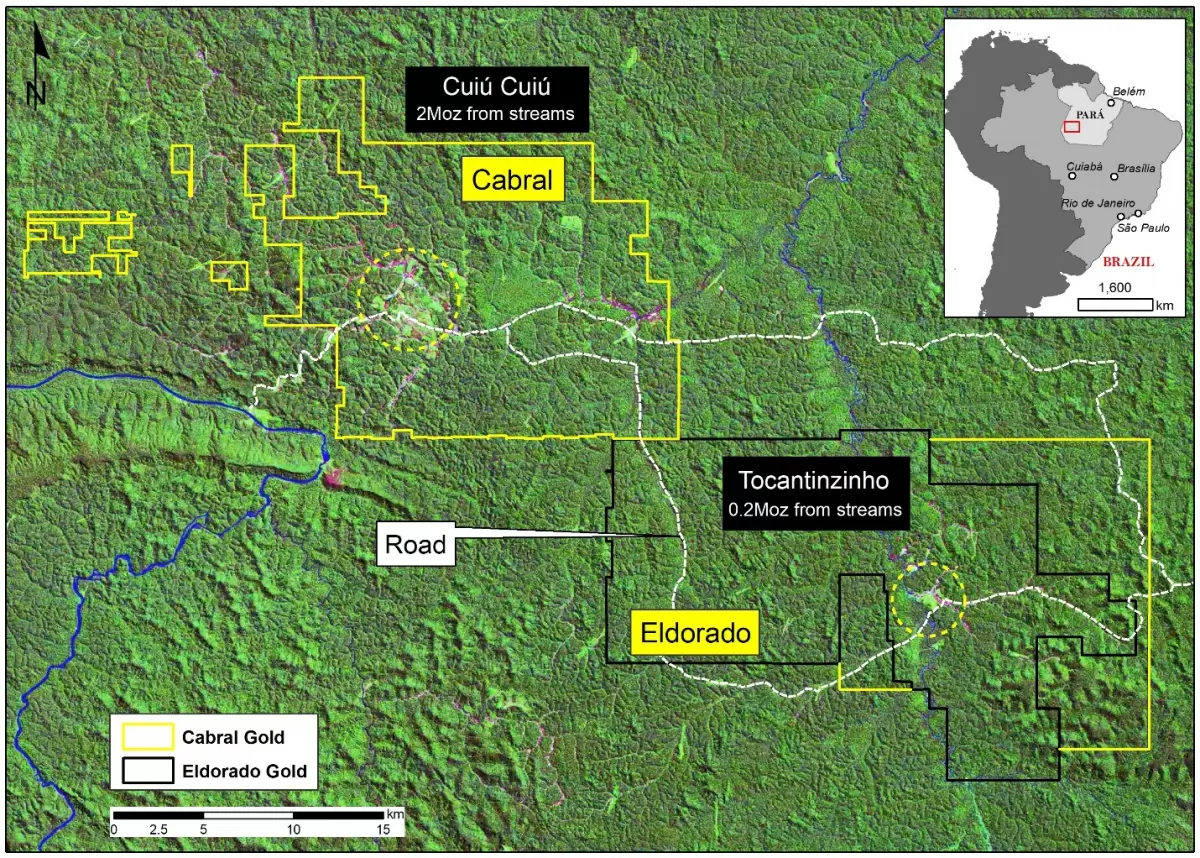

Cabral Gold Inc. (“Cabral” or the “Company”) (TSXV: CBR, OTC: CBGZF) is pleased to announce the completion of a new NI 43-101 gold mineral resource estimate for four deposits at its Cuiú Cuiú Project, located in the state of Pará in northern Brazil. The Cuiú Cuiú property is contiguous to the northwest of Eldorado Gold Corporation’s (“Eldorado Gold”) advanced Tocantinzinho gold project (Figure 1).

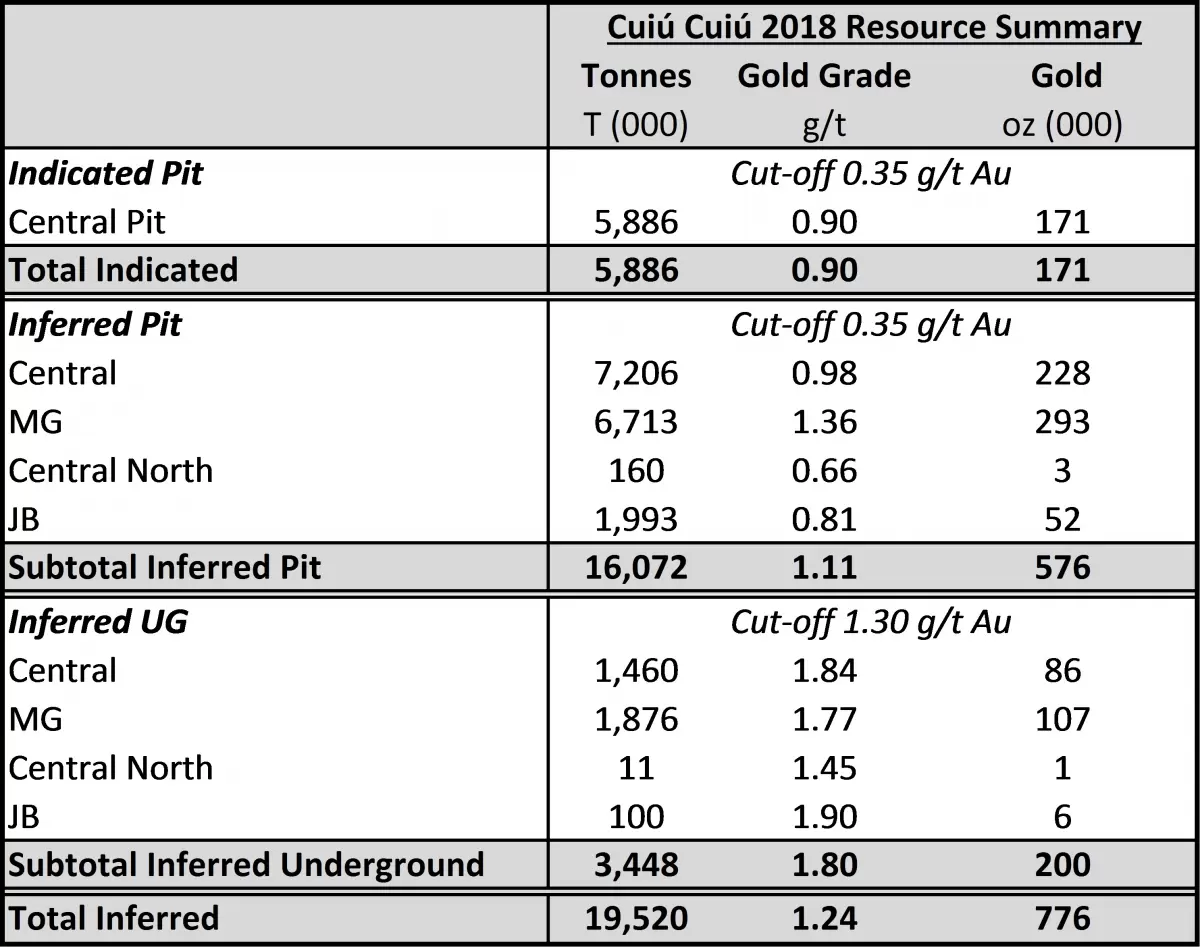

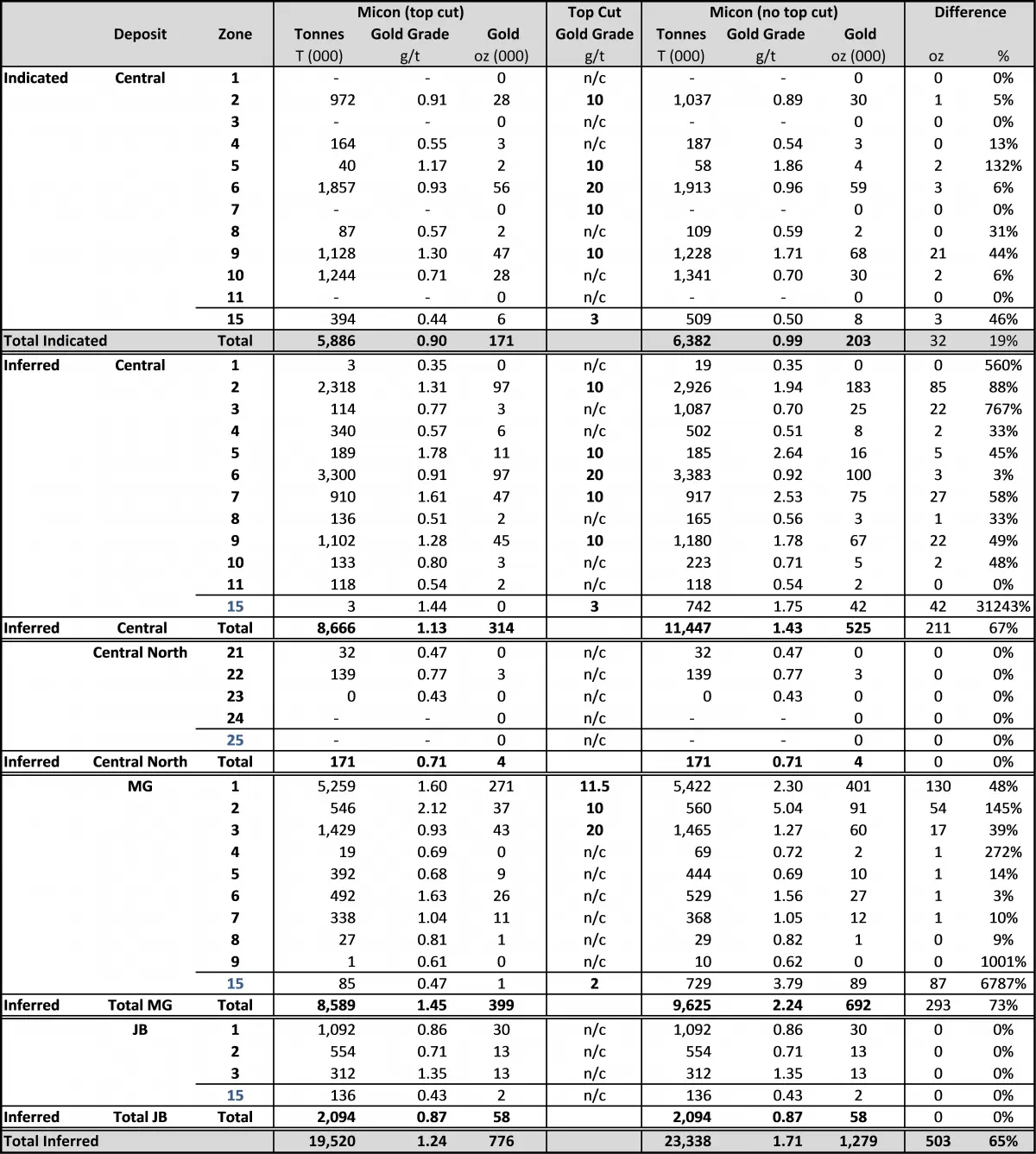

Cabral’s 2018 NI 43-101 Mineral Resource Estimate was completed by Micon International Limited (Micon), and totals 5.9MM tonnes grading 0.9 g/t Au (Indicated) and 19.5MM tonnes grading 1.2 g/t Au (Inferred), or 0.2MM ounces and 0.8MM ounces of gold, respectively (Table 1). Top cuts were applied ranging from 2 to 20 g/t Au. These were determined based on a variety of statistical methods for each subzone of two larger deposits. No top cuts were required for two smaller, lower grade satellite deposits. Economic parameters used in determining pit shell and underground dimensions for this constrained resource were largely based on recent economic studies at Tocantinzinho available on Eldorado Gold’s web site.

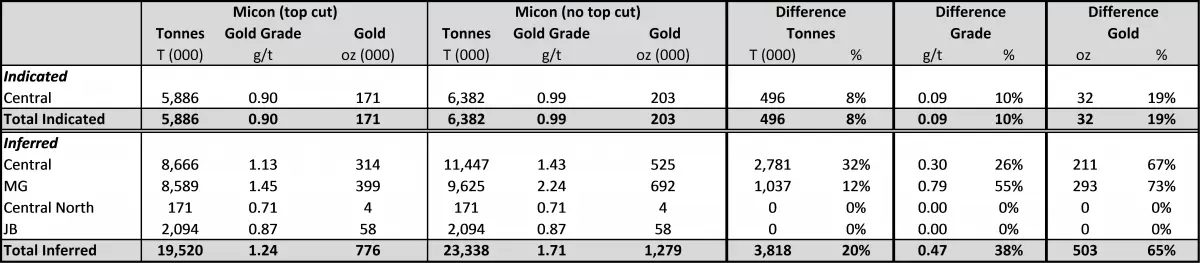

In order to better compare with historic resources. Micon also provided an estimate without top cuts. This should not be considered the current resource estimate. Without applying top cuts, the 2018 pit/underground constrained estimate would report 57% more gold, being 6.4MM tonnes grading 1.0 g/t Au (indicated) and 23.3MM tonnes grading 1.7 g/t Au (inferred), or 0.2MM ounces and 1.3MM ounces of gold, respectively (Table 2).

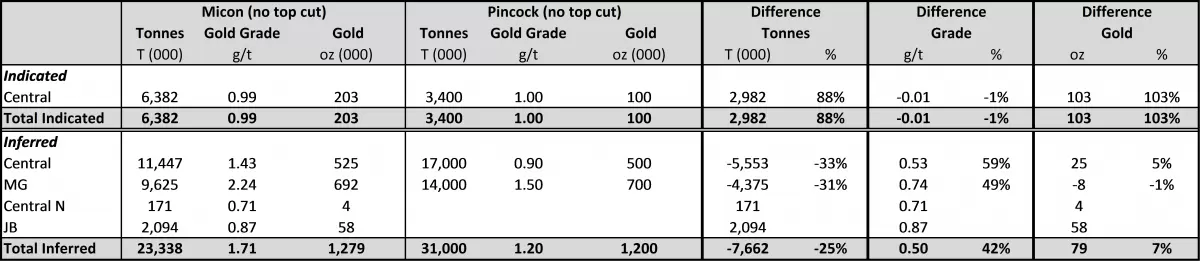

This compares very favourably to a 2011 historic NI 43-101 pit/underground constrained resource of 1.3MM oz Au determined by Pincock, Allen and Holt (“Pincock”). Pincock’s estimate did not apply top cuts, thus it is best compared with Micon’s estimate that excludes top cuts. The 2018 estimate (without top cuts) is a 14% increase from Pincock’s estimate (Table 3). Due to more rigorous economic parameters used in determining the 2018 pit shells, gold grade is 44% higher, while tonnage is 27% lower than the 2011 resource calculation (Table 3).

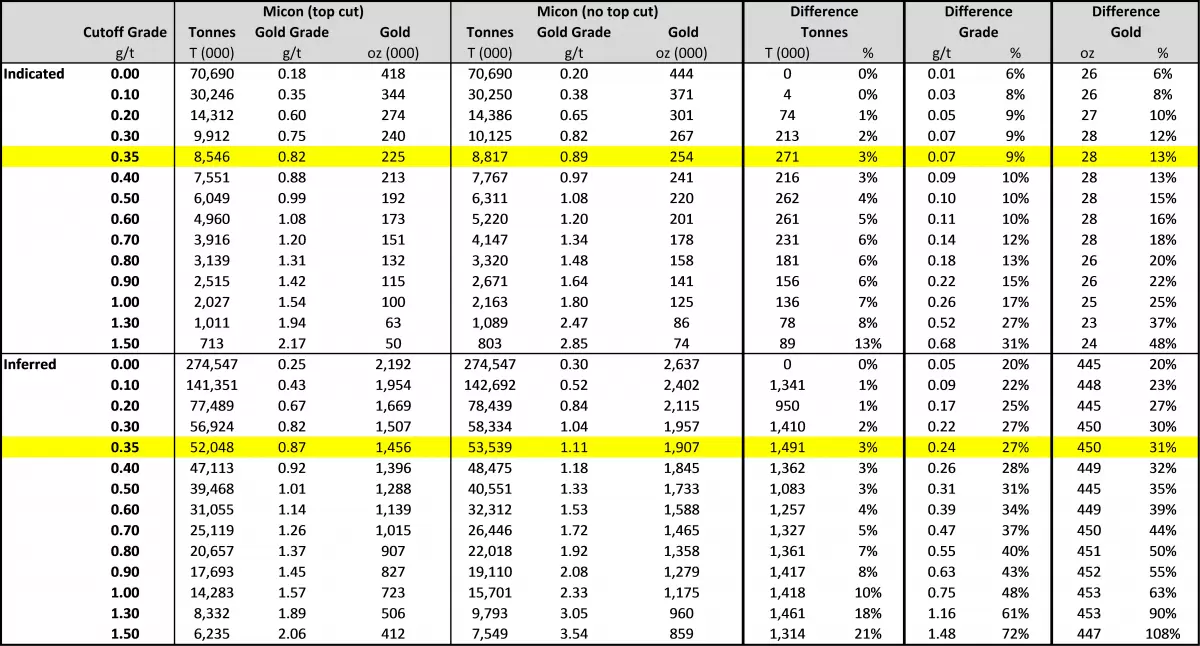

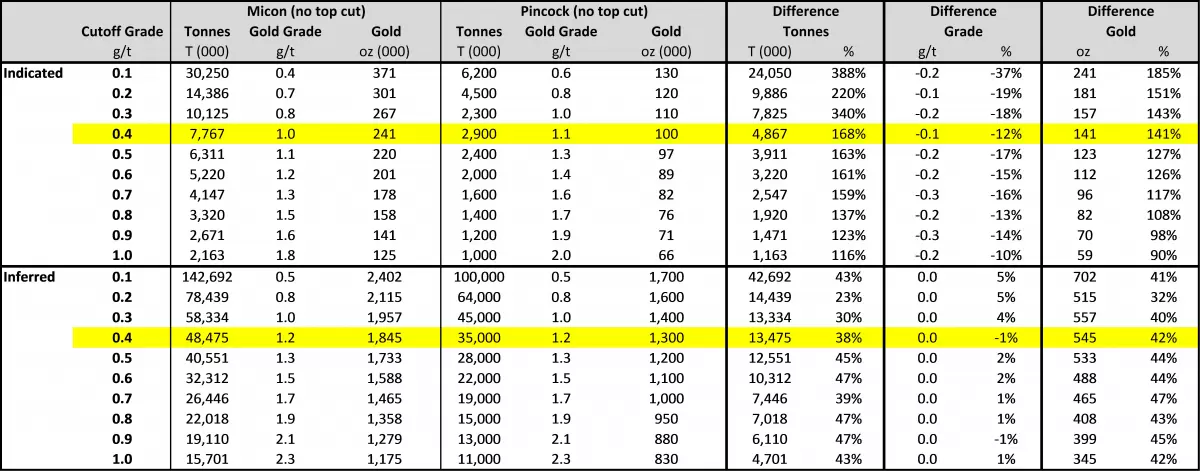

Micon also provided a sensitivity study at various cut-off grades. The selection of top cuts also has a significant impact on sensitivity estimates without pit or underground constraints (Table 4). At a 0.4 g/t Au cut-off, Micon’s unconstrained sensitivity estimate is 30% higher (2.1MM oz of gold) without top cuts than with the top cuts (1.6MM oz of gold). The 2018 sensitivity estimate with no top cut is 49% higher than the 2011 unconstrained Pincock sensitivity estimate (1.4MM oz of gold) using similar methodologies, largely due to a 48% increase in tonnes (Table 5).

Alan Carter, President and CEO said “The 2018 resource estimate is an important fundamental step towards developing an economic platform for the Cuiú Cuiú project. We believe that surface trenching and further drilling will provide additional data that will likely statistically improve top-end cuts, and as a result add significant additional ounces within the existing deposits as well as along strike.

It is worth remembering that previous drilling has identified ten mineralized zones at Cuiú Cuiú, for which only four thus far have sufficient drilling to determine resources, and significant upside exists in all four of the deposits identified to date. Furthermore, the recent recognition of new high-grade targets at Cuiú Cuiú [see news release of March 21, 2018] also represents a very important step towards improving the overall grade and viability of the project through the potential addition of higher grade resources. These efforts will be prioritized, and tested over the coming months”.

Background

Previous drilling on the Cuiú Cuiú property had identified ten largely low-grade, stockwork vein mineralized zones after following up significant soil and stream-sediment survey anomalies and extensive alluvial artisanal workings. Drilling focussed on expanding and delimiting the zones, rather than optimizing grade. Recent work by Cabral has identified numerous additional higher grade vein and stockwork vein targets. Several of these are coincident with significant geochemical and geophysical targets and are the subject of ongoing trenching, channel sampling and soil sampling on surface: some of these are being exploited in places by artisanal workers.

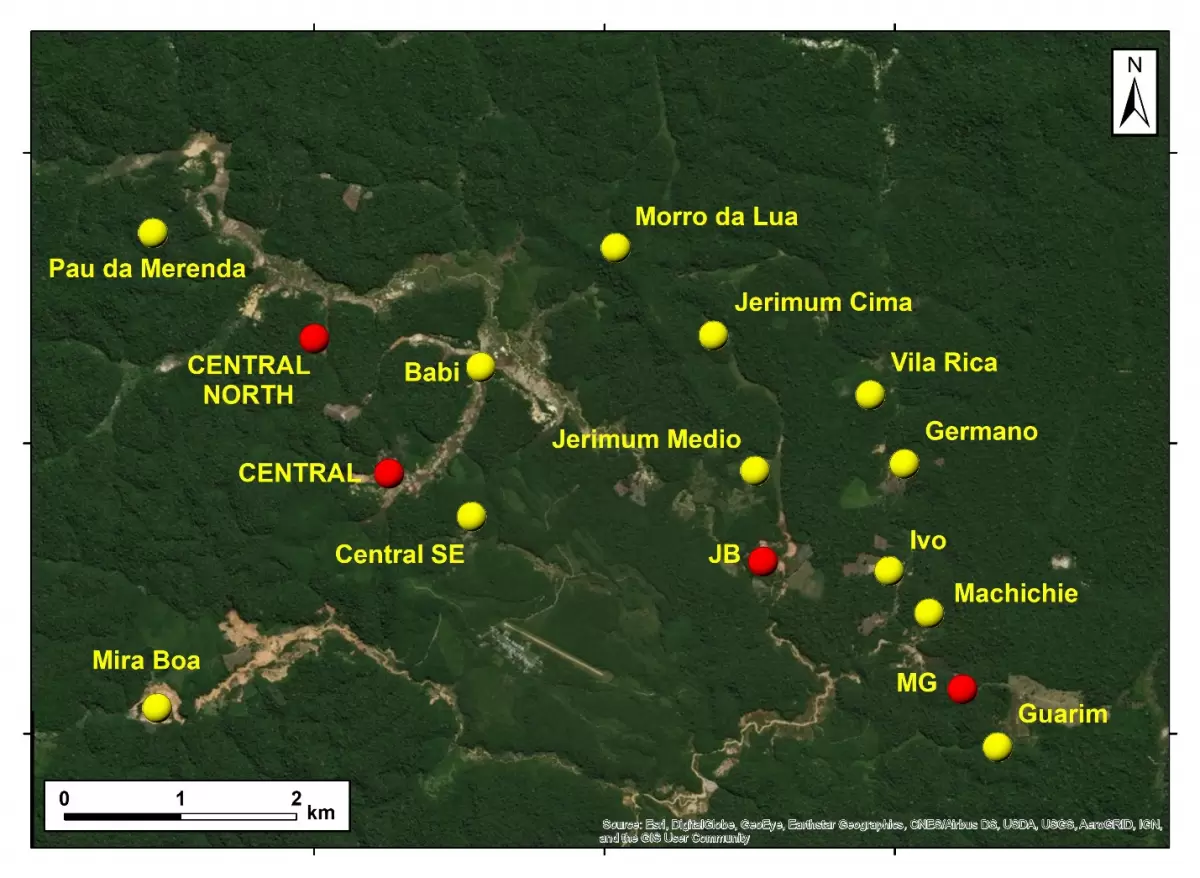

To date there has been sufficient diamond drilling to determine resources on just four deposits: two larger deposits, Central and Moreira Gomes (MG), and two smaller satellite deposits Central North and Jerimum de Baixo (JB) (Figure 2). All remain open at depth and along strike. Central occurs in a broad structural corridor which may also contain other parallel mineralized zones. Newly identified parallel structures close to MG, and extensions of Central North and JB also require drilling and may ultimately expand the footprint of those mineralized areas.

The 2018 NI 43-101 mineral resource estimate was prepared for Cabral by Thomas C. Stubens P.Eng. of Micon. This resource incorporates 108 diamond drill holes (30,448m). All holes were drilled by the previous operator, Magellan Minerals Ltd. (“Magellan”) between, 2006 and 2012. The new resource estimate is considered a significant improvement, when compared to an April 19, 2011 NI 43-101 resource estimate commissioned by Magellan. Those historic resources were determined by Aaron M. McMahon, P.G., of Pincock, but only included 74 diamond drill holes (19,297m) that had been completed prior to December 31, 2010. Based on the available data at the time, Magellan’s historic resources considered only two deposits, Central and MG.

The 2018 Cuiú Cuiú NI 43-101 gold resource estimate is constrained by Whittle pits above conceptual underground stopes. Economic parameters for the pits and gold recoveries were largely based on Eldorado Gold’s June 15, 2015 positive feasibility study at Tocantinzinho, summarized below. Micon also completed sensitivity studies at various cut-off grades without pit or underground economic constraints (unconstrained).

Deposit Descriptions

Gold deposits at Cuiú Cuiú are interpreted to be hosted in northwest and east-trending subordinate shears and faults related to a major northwest trending regional structure. Figure 2 shows the location of the four deposits included in the resource, in addition to other mineralized areas and promising targets.

Mineralization in all four deposits can be described as stockwork/sheeted veinlet mineralized systems hosted within broad, altered shear zones within granitic rocks. Individual veinlets are typically 0.2 to 2.0 cm in width but occasionally are up to 20 cm wide. The pyrite content within the zones of stockwork mineralization, ranges from 0.5 to 4.0 percent in volume. High grade gold zones above 10 g/t Au are associated with elevated levels of both pyrite and base metal sulfides, and display significant silicification. Pyrite is the primary host for native gold, although visible coarse gold is usually associated with base metal sulfides, particularly galena, sphalerite, and chalcopyrite. There is a positive correlation between the frequency of quartz veins, the percentage of sulfides present and gold grade. Gold occurs as the native metal in fracture fillings within pyrite and other sulfides; it occurs on the surfaces of, and in between individual sulfide grains, rarely as inclusions within pyrite.

The east-trending, steep north-dipping Moreira Gomes (MG) Deposit ranges in width up to 65m in the core with several branching splays, and was traced for 2.2km along strike, and from surface to a maximum depth of 360m. This is a narrower, but higher grade zone of mineralization than the other three zones. Particularly important are high-grade auriferous veins (composites up to 104.9 g/t Au) that occur along the hanging-wall and/or footwall contacts in places; however, current drill density is insufficient to better define these higher grade intercepts.

The Central Deposit comprises the widest zone of mineralization identified on the property. Drilling has defined a northwest-trending, steeply dipping deformed zone that contains anastomosing and, or parallel subzones. These sub-zones of gold-bearing, silicified and altered granitic rocks over a strike length of 1.2km, widths up to 190m, and from surface to a maximum depth of 420m. Scattered higher grade gold intercepts up to 39.8 g/t Au were encountered. Drilling to date has not closed off the zone, and it remains open to the northwest, southeast and at depth. Elevated values near the collars and end of many drill holes suggest the width of the deposit has also not yet been fully delimited, and that there may be parallel zones outside the limit of drilling and the current resource.

The northwest-trending Central North Deposit is a smaller zone that occurs directly to the northeast of the main Central Deposit, It has many similarities to Central but is lower grade, with the best 2m composite being just 4.3 g/t gold. Drilling has traced Central North over a strike length of 500m, from surface to a maximum depth of 380m. The width across the package of structures is up to 150m. It remains open to the northwest, southeast and at depth.

Based on existing drilling, the northwest-trending Jerimum de Baixo (JB) Deposit is another smaller and lower grade deposit. The northwest trending deposit has been traced over a strike length of 520m, widths up to 125m, and from surface to a maximum depth of 200m. It remains open to the northwest, southeast and at depth. The highest gold grade encountered in drilling to date was 9.4 g/t Au. New artisanal workings west of JB suggest it may be larger than previously thought.

2018 Resource Estimate Assumptions and Parameters and Results

The 2018 resource estimate commissioned by Cabral focused on four deposits; Central, Moreira Gomes (MG), Central North, and Jerimum de Baixo (JB). The estimate is based on diamond holes completed by Magellan prior to Cabral acquiring that company’s wholly-owned Brazilian subsidiary in 2016.

For the 2018 resource estimate Micon used 51 holes (15,413m) at Central, 35 holes (9,261m) at MG, 7 holes (2,242m) at Central North, and 15 holes (3,532m) at JB; maximum 2m composite gold grades were 39.8 g/t, 104.9 g/t, 4.3 g/t and 9.4 g/t, respectively. A total of 8,442 composites were used in the estimates.

Wireframes were originally generated by Magellan for all four deposits and updated by Micon to account for the new drill data. Central, Central North, MG and JB were modelled as 11, 4, 9, and 3 higher grade mineralized subzones, respectively, surrounded by an encompassing lower grade envelope for each. Gold grades at Central, Central North and Moreira Gomes were estimated using ordinary kriging. Inversed-distance squared (ID2 ) was used at Jerimum de Baixo.

Micon assessed the capping requirement of each sub-zone at Central, Central North, Jerimum de Baixo and Moreira Gomes using a variety of statistics, cumulative frequency plots and other considerations. The capping thresholds which were applied to the 2m composites are summarized in Table 6. Less than half of the mineral zones at Central and Moreira Gomes required capping and no caps were required in the smaller, low-grade Central North and JB deposits.

Constrained gold resources were determined using mining shapes based on a $1,400/oz gold price. Mineable shapes were either Whittle pits or conceptual underground stopes. Resources falling within the pits were reported above cut-off grades of 0.35 g/t Au. Stope shapes only include blocks above a cut-off grade of 1.3 g/t Au. Micon largely assumed the parameters of Eldorado Gold’s 2015 feasibility studies available on that company’s web site. Recoveries were assumed to be 90%. Mining costs used were $2.50/t for fresh rock, and $1.50/t for saprolite; with $3.00 and $8.30 per tonne of ore for G&A and Milling, respectively. Pit slopes selected were 30° for saprolite and 50° for fresh rock.

Sensitivity studies were also provided, using a range of cut-off gold grades, with no pit or underground constraints.

For the 2018 NI 43-101 Resource Estimate, Micon determined a constrained Indicated Resource of 5.9MM tonnes grading 0.9 g/t Au and an Inferred Resource of 19.5MM tonnes grading 1.2 g/t Au (0.2MM ounces and 0.8MM ounces of gold, respectively). 79% of the resource reports to pits (Table 1).

For comparison purposes, Micon also provided pit/underground constrained estimates for each deposit with and without top cuts (Table 2). Without top cuts the constrained estimate reports 57% more gold than with a top cut, being 6.4MM tonnes grading 1.0 g/t Au (indicated) and 23.3MM tonnes grading 1.7 g/t Au (inferred), or 0.2MM ounces and 1.3MM ounces of gold, respectively.

Without pit or underground constraints, Micon’s top-cut selection also has a significant impact on sensitivity studies. At a 0.4 g/t Au cut off, Micon’s unconstrained sensitivity estimate is 30% higher (2.1MM oz of gold) without top cuts than with the top cuts (1.6MM oz of gold).

Historical Resource Estimate Assumptions and Parameters

A 2011 resource estimate commissioned by Magellan focused two deposits, Central and MG. That estimate was based on diamond drilling completed prior to December 31, 2010. At that time, only 50 holes (13,605m) had been completed at Central and 24 (5,692m) at MG. Pincock did not indicate in the report how many of these holes were used in the estimates.

The Pincock resource determination used ordinary kriging, assumed a gold price of $1,250/oz and did not apply top cuts to the gold grades. The mineable shapes were either Lerchs-Grossman pits or conceptual underground stopes. Resources falling within the pits were reported at cut-off grades of 0.3 g/t Au for fresh rock or 0.4 g/t Au for saprolite. Stope shapes only include blocks above a cut-off grade of 1.3 g/t Au. The cut-off grades considered a gold price of $1,250 per ounce and metallurgical recoveries of 91 percent for fresh rock and 66 percent for saprolite. Details on economic parameters used in pit and underground design were not provided in the NI 43-101 report; moreover, the release of the resource preceded publication of Eldorado Gold’s earlier economic studies released in May 2011.

A qualified person has not done sufficient work to classify this historic estimate as current resources, and the issuer is not treating the historic estimate as mineral resources.

For the historic estimate Pincock determined an Indicated Resource of 3.4MMt @ 1.0g/t Au (for 0.1MMoz) and Inferred Resource of 31MMt @ 1.2g/t Au (for 1.2MMoz) for the Central and MG deposits (Table 2). Sensitivity studies without pit or underground constraints are shown in Table 5 at various cut-off gold grades.

For further details, Pincock’s full 43-101 report, dated April 19, 2011, can be viewed on SEDAR under Magellan Minerals Ltd.

Comparison of 2018 and 2011 Resource Estimates

As Pincock did not use a top-end cut for its historic resource estimate, it is best compared to Micon’s estimate that does not include a top cut.

Micon’s 2018 pit and underground constrained estimate without top cuts contains 14% more gold than Pincock’s 2011 constrained estimate. Due to more rigorous economic parameters used in determining the 2018 pit shells, gold grade is 44% higher, while tonnage is 27% lower than the 2011 resource calculation (Table 2).

Micon’s 2018 unconstrained sensitivity study also compares favourably to Pincock’s. At a 0.4 g/t Au cutoff, Micon’s estimate of 2.1MM oz of gold is 49% higher than the 2011 unconstrained Pincock sensitivity study using the same cut-off grade (1.4MM oz of gold), largely due to a 48% increase in tonnes (Table 4).

Future Plans

Cabral is currently engaged in an aggressive surface exploration program at Cuiú Cuiú which involves soil sampling, auger sampling, pitting and trenching on at least 12 targets at Cuiú Cuiú including Central, MG, JB and Central North. This work is aimed at prioritizing targets for diamond drilling later in 2018.

Table 1: Cabral’s 2018 NI 43-101 Mineral Resource Estimate for the Cuiú Cuiú project. These are constrained by open pit (0.35 g/t Au cut-off) and underground (1.30 g/t Au cut-off) mining shapes. Top cuts were applied to certain sub-zones of the Central and MG deposits.

Table 2: Comparison of the Cuiú Cuiú 2018 combined open-pit and underground constrained NI 43-101 resource estimate determined using top cuts, to an estimate provided without top cuts.

Table 3: Comparison of the Micon 2018 pit and underground constrained estimate with historic Pincock 2011 pit and underground constrained resource without applying top cuts.

Table 4: Comparison of 2018 unconstrained sensitivity estimates to cut-off grade, with and without top cuts.

Table 5: Unconstrained sensitivity estimates to cut-off, comparing Micon’s 2018 estimates and Pincock’s 2011 historic estimates without top cuts.

Table 6: Total constrained NI 43-101 Resources with top cuts shown for individual subzones inside optimized pits (0.35 g/t Au cut-off) and underground (1.3 g/t Au cut-off), compared to an estimate provided without top cuts.

Figure 1: Location of Cabral’s Cuiú Cuiú project relative to Eldorado Gold’s TZ project and infrastructure.

Figure 2: Cuiú Cuiú property showing the deposits identified thus far (in red) and main target zones (in yellow).

About Cabral Gold Inc.

The Company is a junior resource company and is engaged in the identification, exploration and development of mineral properties, with a primary focus on gold properties located in Brazil. The Company owns the Cuiú Cuiú gold project located in the Tapajos Region within the state of Para in northern Brazil.

The Tapajós Gold Province is the site of the largest gold rush in Brazil’s history. Cuiú Cuiú was the largest garimpo in the Tapajos and produced an estimate 2Moz of placer gold historically.

FOR FURTHER INFORMATION PLEASE CONTACT:

Alan Carter

President and Chief Executive Officer

Cabral Gold Inc.

Tel: 604.676.5660

Email: info@cabralgold.com

www.cabralgold.com

Thomas C. Stubens P.Eng. of Micon, a consultant to the Company as well as an Independent Qualified Person as defined by National Instrument 43-101, has reviewed the technical information presented in this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of the words “will”, “expected” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. This news release contains forwardlooking statements and assumptions pertaining to the following: strategic plans and future operations, and results of exploration. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct.