Vancouver, British Columbia – March 10, 2022 – Cabral Gold Inc. (“Cabral” or the “Company”) (TSXV: CBR) (OTC: CBGZF) is pleased to provide assay results from two diamond-drill holes testing the MG gold deposit within the Cuiú Cuiú gold district in northern Brazil.

Highlights are as follows:

- DDH271 intersected 2.6m @ 28.9 g/t gold within the primary hard-rock MG gold deposit from 117.5m, including 1.0m @ 64.6 g/t gold from 119.1m. The hole cut a second high-grade interval further down the hole that returned 1.6m @ 32.8 g/t gold from 169.2m, including 0.6m @ 86.1 g/t gold

- DDH271 also encountered significant lower grade gold mineralization within overlying unconsolidated sediments that comprise the gold-in-oxide blanket, returning 25.0m @ 0.6 g/t gold from surface

- DDH270 intersected 10.2m @ 0.6 g/t gold from 93.5m depth, 2.4m @ 1.3 g/t gold from 135.7m and 7.3m @ 1.7 g/t gold from 164.3m all within the primary hard-rock MG gold deposit. DDH270 also cut 33.6m @ 0.3 g/t gold from surface within the overlying gold-in-oxide blanket

Alan Carter, Cabral’s President and CEO commented, “These spectacular drill results from the primary MG gold deposit at Cuiú Cuiú continue to define a significant central high-grade core to the primary hard-rock MG gold deposit. That core is showing greater lateral continuity and extent than previously thought and remains open at depth and along strike. Such bonanza results continue to support the Company’s thesis that there are significant high-grade zones within the current low-grade bulk tonnage resource at Cuiú Cuiú that can be identified and delineated with additional drilling”.

MG Diamond-Drill Results

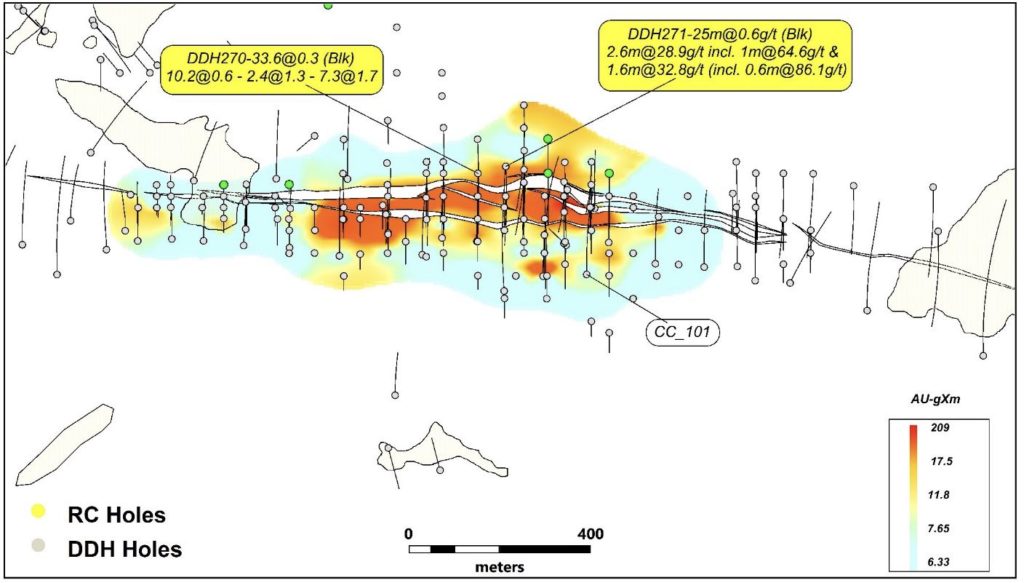

Assay results were returned on two diamond-drill holes (DDH270 and DDH271) that were recently completed within the central part of the MG gold deposit (Figure 1).

Figure 1: Map showing the outline of the primary MG gold deposit that was defined in the 2018 resource estimate (defined by E-W trending zones) and the interpreted grade x thickness contours of the overlying mineralized oxide blanket. The location of recently completed diamond-drill holes (DDH270 and DDH271) are indicated along with historic hole CC101. Very high-grade, or bonanza, intercepts have now been encountered in all six sections from DDH270 to CC101, and that high-grade core zone remains open both on strike and at depth.

DDH271

DDH271 was drilled on section E553570 (Figure 1, Table 1). There was only one historic diamond hole previously drilled into fresh basement on this section (CC_108). Cabral’s RC drilling on this section was designed to define the overlying gold-in-oxide blanket, rather than testing basement mineralization.

The unconsolidated gold-in-oxide blanket returned 25.0m @ 0.6 g/t gold from surface in DDH271 (Figure 2).

Within the underlying fresh basement, there were three separate mineralized zones intersected in DDH271:

- A hanging-wall zone returned 23.7m @ 0.4 g/t gold from 70.8m within altered intrusive rock. It is interpreted to correlate with an intercept in CC108, which is 245m downdip. It is also interpreted to remain open at depth

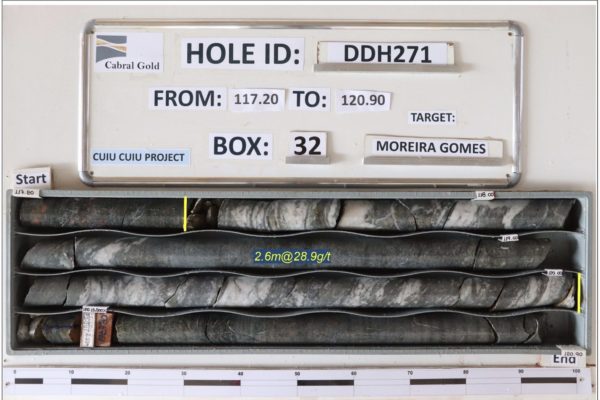

- A zone of bonanza-grade gold mineralization, associated with strong alteration and abundant quartz veining, was intersected from 117.5m (Photo 1). This returned 2.6m @ 28.9 g/t gold, including 1.0m @ 64.6 g/t gold from 119.1m. This is interpreted to be the main MG zone.

- A second very high-grade interval occurs in the footwall. It is also associated with strong alteration and quartz veining, and returned 1.6m @ 32.8 g/t gold from 169.2m, including 0.6m @ 86.1 g/t gold from 169.2m.

Photo 1: Drill core displaying quartz veining and alteration encountered in DDH271, which intersected 2.6m @ 28.9 g/t gold from 117.5m, including 1.0m @ 64.6 g/t gold from 119.1m. The hole also intersected 1.6m @ 32.8 g/t gold from 169.2m, including 0.6m @ 86.1 g/t gold from 169.2m

The two high-grade intervals are interpreted to be subparallel, and to correlate with mineralized zones that were intersected down-dip in hole CC108, which returned 6.7m @ 1.2 g/t gold and 1.0m @ 6.0g/t gold (Figure 2). The intervals in CC108 are located 160m and 100m below the two high-grade intervals encountered in DDH271, and both zones remain open at depth.

Figure 2: Cross section on line E553570 at MG through the primary MG gold deposit and the overlying gold-in-oxide blanket showing the location of DDH271, which intersected 2.6m @ 28.9 g/t gold from 117.5m, including 1.0m @ 64.6 g/t gold from 119.1m, and 1.6m @ 32.8 g/t gold from 169.2m, including 0.6m @ 86.1 g/t gold from 169.2m. All three zones remain open at depth.

DDH270

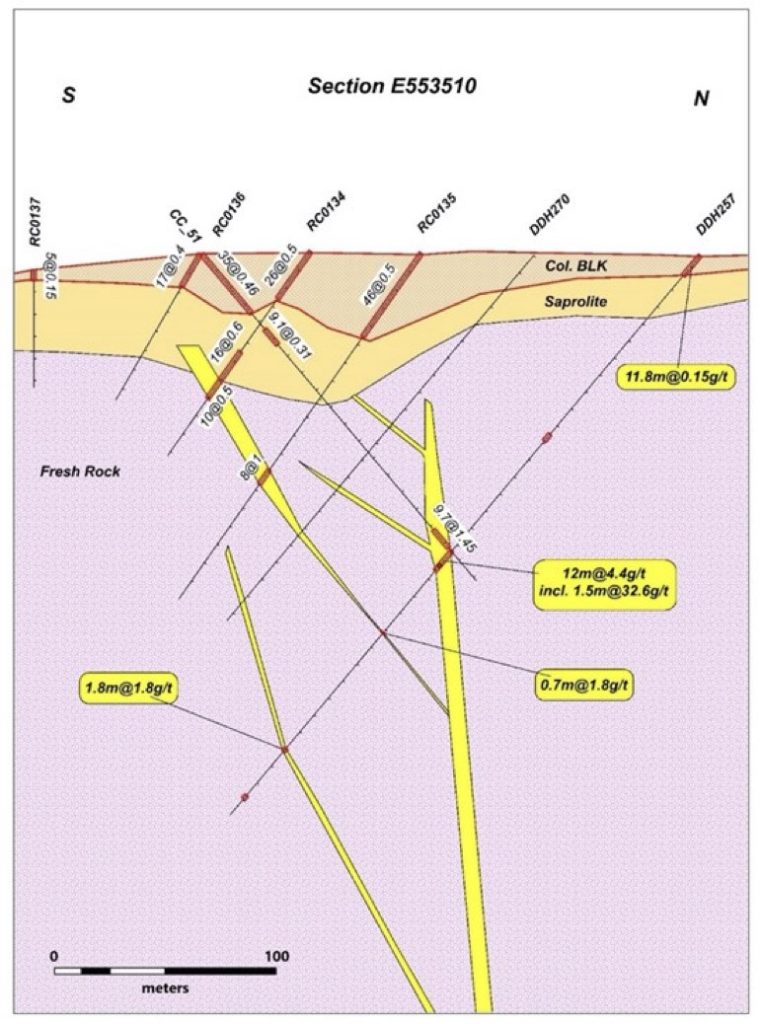

Hole DDH270 was drilled 70m to the west of DDH271 on section E553510 (Figure 1 and 3). It is the same section as DDH257, the results of which were released previously (see Press Release dated February 24, 2022).

DDH270 intersected a thick mineralized interval within the unconsolidated gold-in-oxide blanket, which returned 33.6m @ 0.3 g/t gold from surface.

Within the underlying hard basement rocks, DDH270 cut 10.2m @ 0.6 g/t gold from 93.5m, 2.4m @ 1.3 g/t gold from 135.7m and 7.3m @ 1.7 g/t gold from 164.3m (Table 1).

DDH270 hole was drilled up dip from DDH257 (Figure 3), which returned 12.0m @ 4.4 g/t, within which was an interval of 6.0m @ 8.6 g/t, including 1.5m @ 32.6 g/t gold. This suggests grades on this section may improve with depth, or that these bonanza grades are controlled within high-grade ore shoots that are not constrained by the current drill density. Nevertheless, it is very important to note that the mineralization on this section also remains open at depth.

Figure 3: Cross section on line E553510 at MG through the primary MG gold deposit and the overlying gold-in-oxide blanket showing the location of DDH257, which intersected 6m @ 8.6 g/t gold, including 1.5m @ 32.6 g/t gold. DDH270 returned a thicker zone within the blanket (33.6m @ 0.3 g/t gold), but lower grades within the primary basement, including 10.2m @ 0.6 g/t gold from 93.5m, 2.4m @ 1.3 g/t gold from 135.7m and 7.3m @ 1.7 g/t gold. Note that DDH270 is up dip of DDH257 suggesting that grades may improve with depth. Note the mineralized zone remains open at depth.

Implications for the core high-grade zone at MG

E553510 is the westernmost section of high-grade mineralization defining the central high-grade core at MG. With the bonanza results identified in DDH271, very high-grade gold, or bonanza, mineralization has now been intersected in all six drill sections from E553745 to E553510, a lateral distance of 235m.

Whilst, there may be as yet unidentified controls defining ore-shoots that could control the higher-grade intercepts within the zone, recent drill results show a significant degree of lateral continuity of high-grade intercepts.

On a number of sections, the grade also appears to improve with depth. For example, on Section E553745, which defines the eastern end of the high-grade core, lower grade broad intercepts were encountered in shallower drill holes (see press release dated November 3, 2021), while very high grades were encountered towards the end of historic hole CC101. At 425.2m, CC101 is the deepest hole that has been drilled to date at MG (Figure 1) and the hole returned 25.0m @ 2.3 g/t gold from 396.0m, including 1.5m @ 14.0 g/t gold, 0.75m @15.0 g/t gold, and 1.0m @ 9.2 g/t gold.

Based on drilling to date, the main central basement high-grade mineralized core at MG remains open at depth on all of the six sections. It now has a strike length in excess of 235m, and remains open on strike, both to the east and west (Figure 1).

|

Drill Hole |

Weathering |

Mineralized Zone |

From |

to |

Width |

Grade |

|

|

# |

|

|

|

m |

m |

m |

g/t gold |

|

DDH270 |

Oxide/Saprolite |

Blanket |

|

0.0 |

33.6 |

33.6 |

0.3 |

|

|

Fresh Rock |

|

|

93.5 |

103.7 |

10.2 |

0.6 |

|

|

|

|

|

135.7 |

138.1 |

2.4 |

1.3 |

|

|

|

|

|

164.3 |

171.6 |

7.3 |

1.7 |

|

|

|

|

EOH |

225.2 |

|

|

|

|

DDH271 |

Oxide/Saprolite |

Blanket |

|

0.0 |

25.0 |

25.0 |

0.6 |

|

|

Fresh Rock |

|

|

70.8 |

94.5 |

23.7 |

0.4 |

|

|

|

|

|

117.5 |

120.1 |

2.6 |

28.9 |

|

|

|

|

incl. |

119.1 |

120.1 |

1.0 |

64.6 |

|

|

|

|

|

169.2 |

170.8 |

1.6 |

32.8 |

|

|

|

|

incl. |

169.2 |

169.8 |

0.6 |

86.1 |

|

|

|

|

|

220.4 |

225.3 |

4.9 |

0.2 |

|

|

|

|

EOH |

250.70 |

|

|

|

Table 1: Table showing drill results for recently completed diamond-drill holes DDH270 and DDH271 at MG

Drilling and Trenching Update

Results are currently pending on a further five diamond-drill holes at MG and drilling is continuing.

Results are also currently pending on seven diamond-drill holes at Central and drilling is continuing.

In addition to the extensive diamond-drilling program that is in progress at Central, RC drilling aimed at exploring for, and defining the extent of gold-in-oxide blanket material is also in progress in the Central area. That rig is testing within, and to the north of the northern limits of the current Central resource envelope. Results are currently pending on 25 RC drill holes.

Diamond-drilling continues at the PDM target located 2.5km NW of Central (see press release dated January 12, 2022). Drilling is currently focused on expanding and delimiting the recently discovered mineralized zone in basement granitic rocks. Results on nine diamond drill holes are pending.

A recently introduced fourth diamond drill rig has commenced drilling at the Indio target located approximately 1.5km SE of the MG gold deposit (see press release dated March 3, 2022), bringing the total number of drill rigs currently on site to five.

Following recent positive results from surface trenches west of the main Machichie zone, including 5m @ 8.3 g/t gold (see press release dated February 2, 2022), a series of additional trenches are currently being excavated. Results are currently pending on four additional trenches totaling 300m in length.

About Cabral Gold Inc.

The Company is a junior resource company engaged in the identification, exploration and development of mineral properties, with a primary focus on gold properties located in Brazil. The Company has a 100% interest in the Cuiú Cuiú gold district located in the Tapajós Region, within the state of Pará in northern Brazil. Two gold deposits have so far been defined at Cuiú Cuiú and contain 43-101 compliant Indicated resources of 5.9Mt @ 0.90 g/t (200,000 oz) and Inferred resources of 19.5Mt @ 1.24 g/t (800,000 oz).

The Tapajós Gold Province is the site of the largest gold rush in Brazil’s history producing an estimated 30 to 50 million ounces of placer gold between 1978 and 1995. Cuiú Cuiú was the largest area of placer workings in the Tapajós and produced an estimated 2Moz of placer gold historically.

FOR FURTHER INFORMATION PLEASE CONTACT:

“Alan Carter”

President and Chief Executive Officer

Cabral Gold Inc.

Tel: 604.676.5660

Guillermo Hughes, MAusIMM and FAIG., a consultant to the Company as well as a Qualified Person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statements

This news release contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). The use of the words “will”, “expected” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such forward-looking statements should not be unduly relied upon. This news release contains forward-looking statements and assumptions pertaining to the following: strategic plans and future operations, and results of exploration. Actual results achieved may vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. The Company believes the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct.

Notes

Gold analysis has been conducted by SGS method FAA505 (fire assay of 50g charge), with higher grade samples checked by FAA525. Analytical quality is monitored by certified references and blanks. Until dispatch, samples are stored under the supervision the Company’s exploration office. The samples are couriered to the assay laboratory using a commercial contractor. Pulps are returned to the Company and archived. Drill holes results are quoted as down-hole length weighted intersections.